My Funded FX About Us

Exclusive Code 10%: «PROP10»

Company Background and Mission

MyFundedFX About Us begins with an understanding of the firm’s core goals. SeacrestFunded, previously known as My Funded FX, was established to provide traders access to simulated capital in a controlled trading environment. The company’s stated purpose is to support global traders in building real-world experience by offering access to funded accounts without risking personal capital.

Mission and Objectives:

- Enable traders to grow in a structured, simulated environment

- Provide support resources including tutorials, trading education, and community engagement

- Encourage strategy development through real-time simulated trading

SeacrestFunded maintains a separation between trading operations and brokerage services. It does not collect deposits and is not a licensed broker.

Key Entities

| Entity Name | Registration Location | Registration Number |

| MyFunded Capital (HK) Ltd | Hong Kong | 76252354 |

| MyFunded Capital Solutions Ltd | Nicosia, Cyprus | 76252354 |

Evaluation Structure and Simulated Challenges

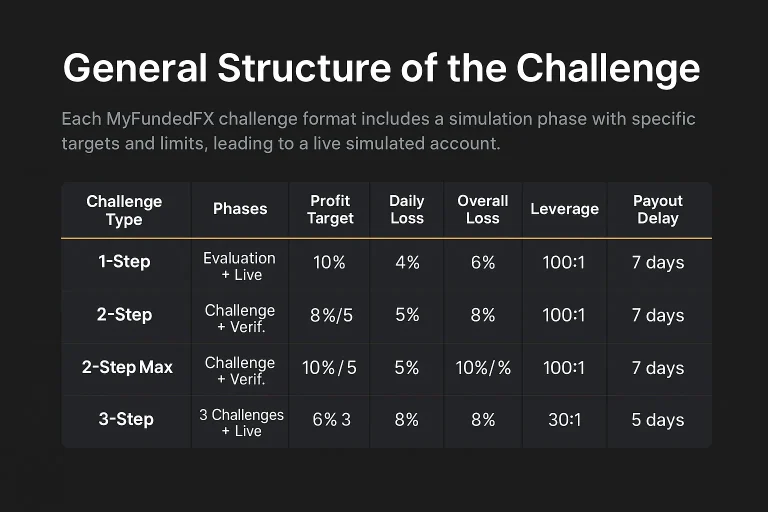

The company offers multiple challenge types. These differ by number of phases, required targets, loss thresholds, leverage, and payout timing. Below is a complete comparison:Challenge Overview

| Challenge Type | Phases | Profit Target | Daily Loss | Overall Loss | Leverage | Min Days | Payout Delay |

| 1-Step | Evaluation + Live | 10% | 4% | 6% | 100:1 | 3 | 7 days |

| 2-Step | Challenge + Verif. | 8% / 5% | 5% | 8% | 100:1 | 3 / 3 | 7 days |

| 2-Step Max | Challenge + Verif. | 10% / 5% | 5% / 4% | 10% / 8% | 50:1 → 30:1 | 3 / 3 | 7 days |

| 3-Step | 3 Challenges + Live | 6% x 3 | 4% | 8% | 30:1 | 1 | 5 days |

Program Features

- No time limit: Unlike many competitors, there is no deadline to complete any phase.

- Simulated capital only: No personal capital is ever deposited. All trading is on simulated environments.

- Realistic trading terms: Traders face real-world leverage settings and must meet both profit and drawdown criteria.

Trading Conditions and Tools

SeacrestFunded allows for wide flexibility within a structured risk framework:

Key Benefits

- Trading freedom: No restrictions on strategy, timeframes, or holding over weekends/news.

- Community support: Access to trader forums and learning materials.

- Transparent structure: No hidden conditions; rules are defined publicly on the website.

These design choices provide structure but also place responsibility on the trader to stay within limits.

Funding and Account Scaling

Once a trader completes the required phase(s), they are moved to a simulated “live” environment. They may then qualify for simulated account scaling.

Example: Account Sizes and Fees

Simulated Account Size | Registration Fee (One-Time) |

$10,000 | $70 |

$25,000 | $140 |

$50,000 | $210 |

$100,000 | $280 |

No further charges apply once an account is funded. Profit split applies only after successful trades in live simulated environments. SeacrestFunded offers a payout ratio of 80% to the trader, paid every 5-7 business days.

Scaling Option

Live accounts can be scaled gradually up to a maximum simulated size of $1.5 million, depending on consistency and drawdown performance. This is not automatic and requires approval after periodic reviews.

Geographic Restrictions

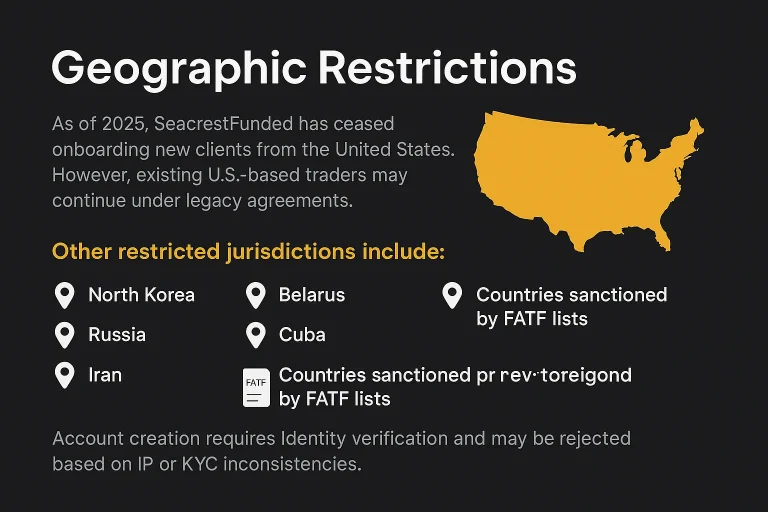

As of 2025, SeacrestFunded has ceased onboarding new clients from the United States. However, existing U.S.-based traders may continue under legacy agreements.

Other restricted jurisdictions include:

- North Korea

- Belarus

- Russia

- Cuba

- Iran

- Countries sanctioned by FATF lists

Account creation requires identity verification and may be rejected based on IP or KYC inconsistencies.

Conclusion

To summarize My Funded FX about us, the program offers structured simulated trading phases with defined targets, loss limits, and no deadline constraints. Traders operate in a non-broker environment, with accounts fully simulated. The process is designed for discipline and steady growth, without requiring financial deposits or engaging in real-market risk. The tools, rules, and structure are clearly laid out on the official site. Participants are expected to adhere to those rules and demonstrate risk awareness at each phase.

FAQ:

All trading is done on simulated environments. No live capital is at risk.

There is no time limit. You can progress at your own pace.

For funded simulated accounts, payouts are processed every 5 to 7 business days.

Use of VPN to bypass jurisdiction limits violates terms and may result in account termination.

Performance is measured against fixed targets (profit, drawdown, days traded) and monitored continuously via internal dashboards.