MyFundedFX Challenge

Exclusive Code 10%: «PROP10»

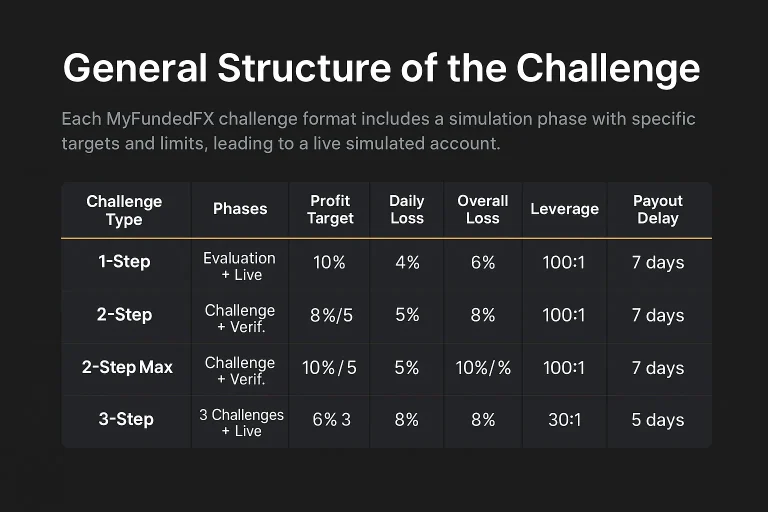

General Structure of the Challenge

Each myfundedfx challenge format begins with a simulation phase, during which traders are required to meet a specific profit target without violating risk constraints. These simulations mimic real market conditions but are entirely demo-based. After passing the challenge and verification phases, the trader enters a live simulated account where they become eligible for performance-based payouts.

The firm offers four core programs, each differing in risk rules, progression pace, and payout access. Below is a breakdown of what each includes.

Challenge Overview by Format

| Challenge Type | Phases | Profit Target | Daily Loss | Overall Loss | Leverage | Min Days | Payout Delay |

| 1-Step | Evaluation + Live | 10% | 4% | 6% | 100:1 | 3 | 7 days |

| 2-Step | Challenge + Verif. | 8% / 5% | 5% | 8% | 100:1 | 3 / 3 | 7 days |

| 2-Step Max | Challenge + Verif. | 10% / 5% | 5% / 4% | 10% / 8% | 50:1 → 30:1 | 3 / 3 | 7 days |

| 3-Step | 3 Challenges + Live | 6% x 3 | 4% | 8% | 30:1 | 1 | 5 days |

Key Trading Rules Applied During Evaluation

During the challenge, every trade is monitored against the firm’s rule engine. A breach of any condition—even by one cent—results in immediate disqualification.

Core Rules During Evaluation

- All trades occur in a simulated environment.

- Daily simulated loss limits must not be exceeded at any time.

- Overall drawdown is calculated based on balance and must remain within set caps.

- A minimum number of profitable days must be logged in each phase.

- All profit must be achieved through consistent gains (no spikes > 50% in one day).

- All positions must comply with trading periods, especially during news.

These rules are enforced regardless of platform used—MatchTrader or DXtrader.

Scaling Plan and Long-Term Funding Path

MyFundedFX offers a scaling model designed for traders who remain consistent over time. After passing the challenge and trading for three months without violating rules, eligible traders may request a balance increase.

Scaling Timeline

Period Active | Growth Criteria | Account Increase |

After 3 Months | +12% profit | +25% |

After 6 Months | +12% profit again | +25% |

After 9 Months | Repeat | +25% |

Max Limit | 5x account value or $1.5M | Cap reached |

This is not automatic. Traders must request scaling and must not have dropped below the starting balance in the last 90-day window.

Challenges with Challenge Completion

Traders often fail for reasons unrelated to profit targets. Here’s a breakdown of the most frequent blockers.

Common Reasons for Disqualification

- Reaching the profit target but violating daily drawdown.

- Incomplete minimum trading days, especially in fast scalping setups.

- Opening or closing trades too close to news events (within 3-minute window).

- Making over 50% of total gain in a single day (violates consistency rule).

- Not requesting verification or payout in time, letting the account expire.

The firm does not reinstate failed accounts, regardless of how close the target was reached.

Conclusion

The myfundedfx challenge system is a structured and rule-governed process that requires more than a good strategy. It requires risk discipline, patience, and a clear understanding of how profit is measured in a simulated environment. Traders must select the program that fits their style, execute within clear rules, and prepare for a consistent approach—not a fast win.

Compared to many firms in the same space, MyFundedFX enforces real constraints that simulate broker conditions and test whether a trader is scalable. There are no exceptions in rule enforcement. Success in the challenge depends less on market calls and more on structure management.

FAQ:

No. Once an account is registered under a specific myfundedfx challenge format, it must be completed in that format.

The account fails. Rule breaches override all other metrics.

Yes, if the accounts are of the same type and phase, and the request is approved by support.

In most cases, payouts can be requested every 7 days (or 5 for 3-Step accounts) after meeting minimum calendar trading days.

No EAs are permitted in any challenge format unless specifically approved. The environment is designed for manual trading evaluation.