My Funded FX Leverage

Exclusive Code 10%: «PROP10»

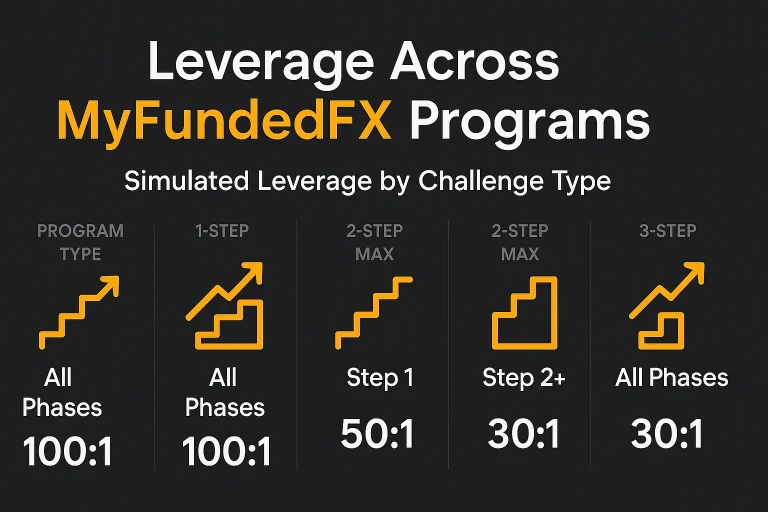

Leverage Across My Funded FX Programs

My Funded FX offers several trading paths: 1-Step, 2-Step, 2-Step Max, and 3-Step challenges. Each path applies leverage differently, depending on the account phase. Here’s a breakdown.

Simulated Leverage by Challenge Type

Program Type | Step | Sim Leverage |

1-Step | All Phases | 100:1 |

2-Step | All Phases | 100:1 |

2-Step Max | Step 1 | 50:1 |

2-Step Max | Step 2+ | 30:1 |

3-Step | All Phases | 30:1 |

As shown, My Funded FX leverage in the 1-Step and 2-Step programs is consistently set at 100:1. However, for the 2-Step Max and 3-Step programs, it gradually lowers as the trader progresses, highlighting a more conservative approach.

How My Funded FX leverage Impacts Evaluation Phases

Leverage affects position sizing, margin requirements, and overall exposure. Here’s how leverage aligns with the trading rules across different programs:

Program Objectives and Risk Parameters

| Program | Step | Profit Target | Daily Loss | Overall Loss | Minimum Days |

| 1-Step | Evaluation | 10% | 4% | 6% | 1 |

| Live Sim | None | 4% | 6% | 7 | |

| 2-Step | Step 1 | 8% | 5% | 8% | 1 |

| Step 2 | 5% | 5% | 8% | 1 | |

| Live Sim | None | 5% | 8% | 7 | |

| 2-Step Max | Step 1 | 10% | 5% | 10% | 3 |

| Step 2 | 5% | 4% | 8% | 3 | |

| Live Sim | None | 4% | 8% | 7 | |

| 3-Step | Step 1-3 | 6% | 4% | 8% | 1 |

| Live Sim | None | 4% | 8% | 5 |

Traders should consider how decreasing leverage in later stages (notably in 2-Step Max and 3-Step programs) influences their ability to hit targets, especially under strict loss thresholds.

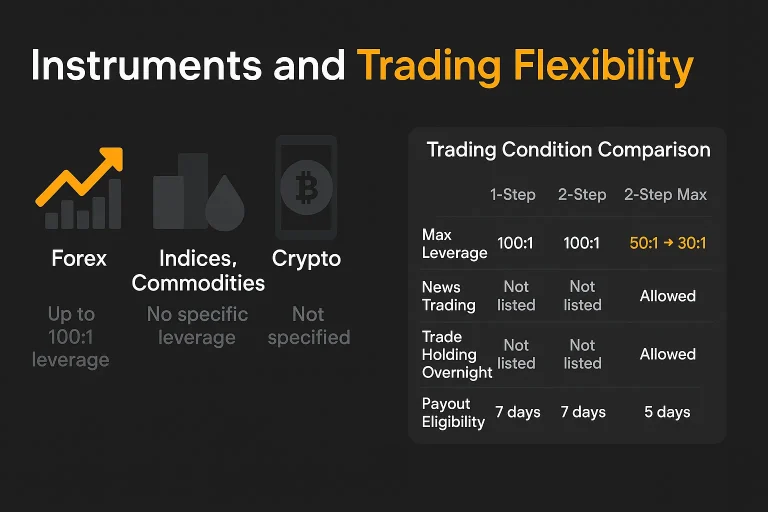

Instruments and Trading Flexibility

All programs allow trading across instruments, but the leverage ratio affects margin per instrument:

- Forex: Up to 100:1 (1-Step, 2-Step), reduced to 30:1 in final stages of other programs.

- Indices, Commodities: No specific per-asset leverage listed, assumed proportional to overall account leverage.

- Crypto: No leverage details; assumed under same account-wide cap.

Trading Condition Comparison

| Feature | 1-Step | 2-Step | 2-Step Max | 3-Step |

| Max Leverage | 100:1 | 100:1 | 50:1 → 30:1 | 30:1 |

| News Trading | Not listed | Not listed | Allowed | Allowed |

| Trade Holding Overnight | Not listed | Not listed | Allowed | Allowed |

| Payout Eligibility | 7 days | 7 days | 7 days | 5 days |

Risk Management and Strategy Implications

Leverage at My Funded FX isn’t extreme compared to some firms that offer 200:1 or 500:1. This design encourages discipline. Here are points traders should note:

- Reduced leverage requires tighter entries. The less margin available, the less room there is for error.

- Capital exposure is more controlled. This can reduce the temptation to over-leverage on volatile instruments.

- Position sizing needs adjustment across phases. Especially when going from 50:1 to 30:1 in 2-Step Max.

Considerations for Traders

- Adjust lot sizing per phase.

- Account for lower leverage when trading during high volatility.

- Use pending orders instead of market entries when close to limits.

MyFundedFX Leverage in Practice: Pros and Limitations

Pros:

- Predictable leverage across most programs (especially 1-Step, 2-Step)

- Structured to lower risk in advanced phases

- Supports a wide range of instruments

Limitations:

- Reduction in leverage can hinder aggressive short-term strategies

- No dynamic leverage based on equity or drawdown

Crypto leverage not clearly defined

Conclusion

The implementation of My Funded FX leverage across trading programs is systematic and intended to moderate risk rather than enable high exposure. Most traders will find the leverage sufficient for Forex, but the shift in ratios between phases—especially in 2-Step Max—demands strategic adjustment. Whether you’re running a conservative or aggressive setup, adapting to phase-specific leverage rules is not optional—it’s essential. If you’re planning on participating, align your strategy with the available margin and don’t assume leverage will remain constant throughout your journey.

FAQ:

100:1, applicable in the 1-Step and 2-Step programs during the evaluation and live simulation stages.

Yes, especially in the 2-Step Max and 3-Step programs. It drops to 50:1 and 30:1 as traders progress.

While leverage is account-wide, Forex is implicitly prioritized. No explicit per-instrument ratios for commodities or crypto are listed.

Yes, in most programs. Holding trades is explicitly allowed in 2-Step Max and 3-Step; others do not prohibit it.

Leverage typically remains the same as the final verification stage, especially in programs where it drops to 30:1.