MyFundedFX Review

Exclusive Code 10%: «PROP10»

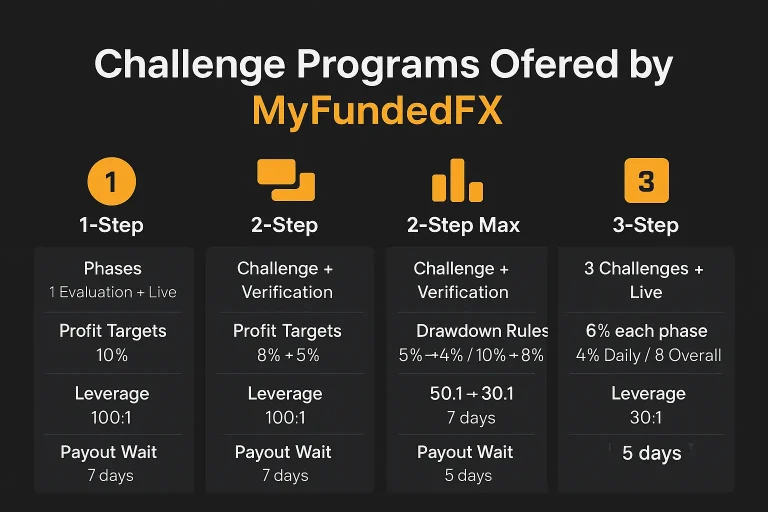

Challenge Programs Offered by MyFundedFX

MyFundedFX currently provides four primary types of trading challenges. Each of them leads into a live simulated account if passed, where profit splits and withdrawals become available.

Overview of MyFundedFX Challenge Structures

| Challenge Type | Phases | Profit Targets | Drawdown Rules | Leverage | Payout Wait |

| 1-Step | 1 Evaluation + Live | 10% | 4% Daily / 6% Overall | 100:1 | 7 days |

| 2-Step | Challenge + Verification | 8% + 5% | 5% Daily / 8% Overall | 100:1 | 7 days |

| 2-Step Max | Challenge + Verification | 10% + 5% | 5%→4% / 10%→8% | 50:1→30:1 | 7 days |

| 3-Step | 3 Challenges + Live | 6% each phase | 4% Daily / 8% Overall | 30:1 | 5 days |

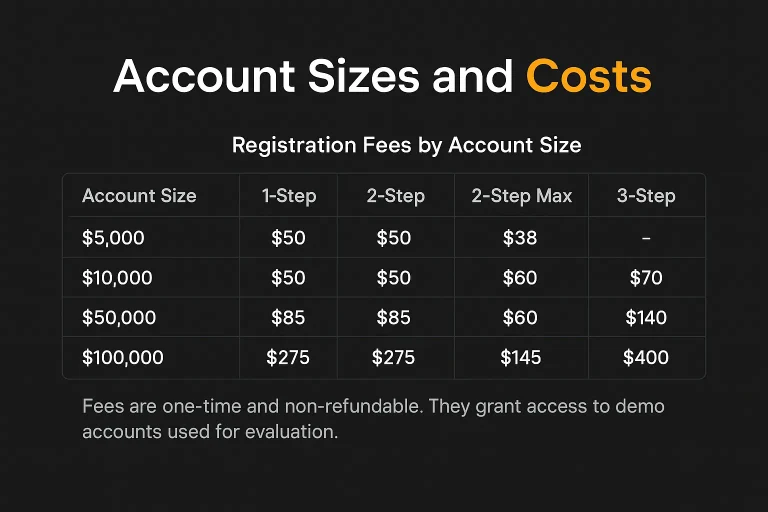

Account Sizes and Costs

Traders can select from a wide range of simulated account sizes, depending on the challenge type they choose. The table below shows the entry costs.Registration Fees by Account Size

| Account Size | 1-Step | 2-Step | 2-Step Max | 3-Step |

| $5,000 | $50 | $50 | $38 | – |

| $10,000 | $50 | $50 | $38 | $70 |

| $25,000 | $85 | $85 | $60 | $140 |

| $50,000 | $165 | $165 | $95 | $250 |

| $100,000 | $275 | $275 | $145 | $400 |

MyFundedFX review: Key Strengths and Weaknesses

This section summarizes the major upsides and constraints based on the structure and actual rules in place.

Main Strengths

- Simulated challenges have no time limits.

- Full rule transparency from the first login.

- Multiple challenge formats allow tailoring to different styles.

- Leverage is consistent with real brokerage exposure limits.

- Scaling plan extends simulated capital up to $1.5 million.

Key Limitations

- Breach of any rule (even after hitting the target) results in account failure.

- Some challenge formats (e.g., 3-Step) are slower to reach payout access.

- No automated trading tools (EAs) are allowed unless stated otherwise.

- No refund or recovery if disqualified due to one mistake.

These limitations are not unique in the proprietary trading space, but they require careful attention.

Payout Mechanics and Withdrawal Policy

Payouts are processed after the minimum calendar trading days have passed in the live simulated phase. Traders are eligible for an 80% split of simulated profits.Withdrawal Conditions

| Challenge | Payout Access After | Consistency Rule | Profit Split | Payout Interval |

| 1-Step Live | 7 calendar days | 50% per day cap | 80% | Every 7 days |

| 2-Step Live | 7 calendar days | 50% per day cap | 80% | Every 7 days |

| 2-Step Max Live | 7 calendar days | 50% per day cap | 80% | Every 7 days |

| 3-Step Live | 5 calendar days | 50% per day cap | 80% | Every 5 days |

Platform Access and Performance

MyFundedFX allows users to choose between multiple platforms. This offers some flexibility depending on layout preference and analytical tools.Platform Feature Comparison

| Platform | Charting Engine | Device Support | Automation | Suitable For |

| DXTrader | TradingView | Web / Mobile | No | Strategy-based users |

| MatchTrader | Built-in | Web / Mobile | No | Simpler interface |

| cTrader | Native | Desktop + Mobile App | Limited | Experienced users |

Scaling Plan and Account Growth

Traders who demonstrate profitability and rule adherence over a 90-day window can request account scaling. The structure is designed for long-term simulated growth.

Scaling Conditions

Time Passed | Profit Requirement | New Account Size |

3 months | +12% | +25% |

6 months | Repeat | +25% |

9+ months | Repeat | Up to $1.5M cap |

Scaling does not reset the account. It builds on top of the trader’s performance and unlocks gradually.

Conclusion

This myfundedfx review makes clear that the firm operates a rules-first system. All challenge formats revolve around drawdown control, minimum trading days, and hitting a profit percentage target. There are no time limits, which benefits swing and part-time traders. However, rules are enforced without exception—reaching the target but violating drawdown still results in failure.

Platform choices are reasonable, payout structure is predictable, and the scaling model encourages discipline. Traders who rely on system automation, shortcuts, or inconsistent gains will likely struggle with this model. But for those who maintain clean performance under structured conditions, MyFundedFX provides a clear path through demo-based funding stages into regular simulated payouts.

FAQ:

No. Once you choose a platform (DXTrader, MatchTrader, etc.), it cannot be changed mid-phase.

No. All challenge types are unlimited in time, but minimum calendar days apply.

The account is failed, and you must restart. There are no exceptions.

Yes. Profits are calculated in a demo environment, but payouts are real and issued based on compliance.

No. Challenge fees are non-refundable regardless of the reason for disqualification.