MyFundedFX Rules

Exclusive Code 10%: «PROP10»

How the myfundedfx rules are structured

The trading process at MyFundedFX is divided into phases, each governed by its own rule set. These phases cover both evaluation and post-verification simulated trading. The rules apply consistently across all challenge types (1-Step, 2-Step, 2-Step Max, and 3-Step). While the format of each phase differs slightly, most core principles—such as loss limits, minimum days, and leverage—remain recognizable.

Here’s a detailed breakdown of each rule category that affects traders during their journey with MyFundedFX.

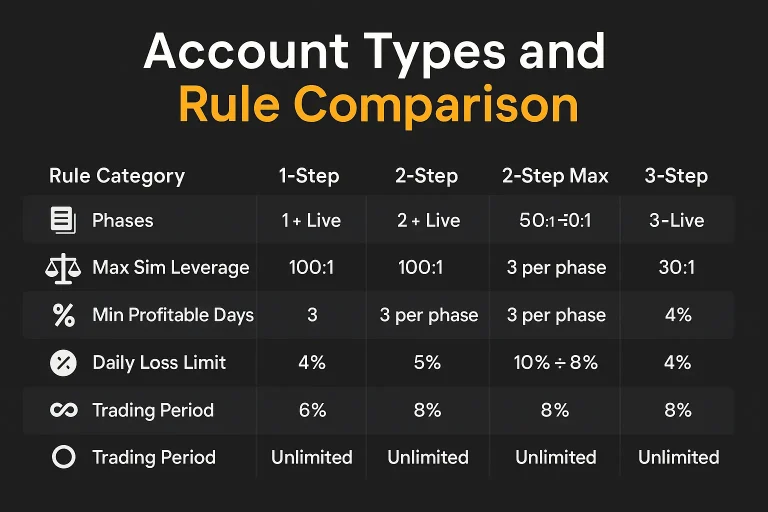

Account Types and Rule Comparison

The table below provides an overview of rule variations across different account types:| Rule Category | 1-Step | 2-Step | 2-Step Max | 3-Step |

| Phases | 1 + Live | 2 + Live | 2 + Live | 3 + Live |

| Max Sim Leverage | 100:1 | 100:1 | 50:1 → 30:1 | 30:1 |

| Min Profitable Days | 3 | 3 per phase | 3 per phase | 1 per phase |

| Daily Loss Limit | 4% | 5% | 5% → 4% | 4% |

| Total Loss Limit | 6% | 8% | 10% → 8% | 8% |

| Trading Period | Unlimited | Unlimited | Unlimited | Unlimited |

Trading Conduct Rules (Applies to All Programs)

These myfundedfx rules focus on trading behavior. They are enforced regardless of program selection:

- Simulated Environment:

All phases use demo environments, even the “Live Simulated” phase. No actual funds are traded. Traders receive payouts from profits generated in simulated conditions. - Loss Limits:

Daily and total drawdowns are strictly monitored. If either is breached—even for a moment—the account is failed. - Minimum Trading Days:

Traders must meet minimum active days before evaluation is considered complete. Profitable trades must occur on separate days. - Leverage Application:

Leverage is static within each program type but can be reduced across phases (especially in 2-Step Max and 3-Step). - Trading Window:

MyFundedFX allows trading at all times, including news releases. However, trades opened or closed within 3 minutes before or after high-impact news are not counted toward profit evaluation.

Evaluation Targets and Requirements

To pass the evaluation phases, traders must reach profit targets without violating any of the above conditions. Below is a simplified table of the main parameters for each phase:| Phase | Target Profit | Daily Loss | Total Loss | Min Days |

| 1-Step | 10% | 4% | 6% | 3 |

| 2-Step Phase 1 | 8% | 5% | 8% | 3 |

| 2-Step Phase 2 | 5% | 5% | 8% | 3 |

| 2-Step Max P1 | 10% | 5% | 10% | 3 |

| 2-Step Max P2 | 5% | 4% | 8% | 3 |

| 3-Step P1–P3 | 6% per phase | 4% | 8% | 1 |

Limitations Built Into the Rules

While flexibility is offered in terms of trading style (scalping, swing, etc.), certain hard rules cannot be bypassed. These include:

- Breaching the loss limit at any point results in instant failure.

- Reaching the profit target but not satisfying minimum trading days disqualifies progression.

- Leverage reductions in later phases must be accounted for in strategy planning.

- Positions executed around news are excluded from qualification scoring.

- EA trading (Expert Advisors) is restricted unless explicitly permitted.

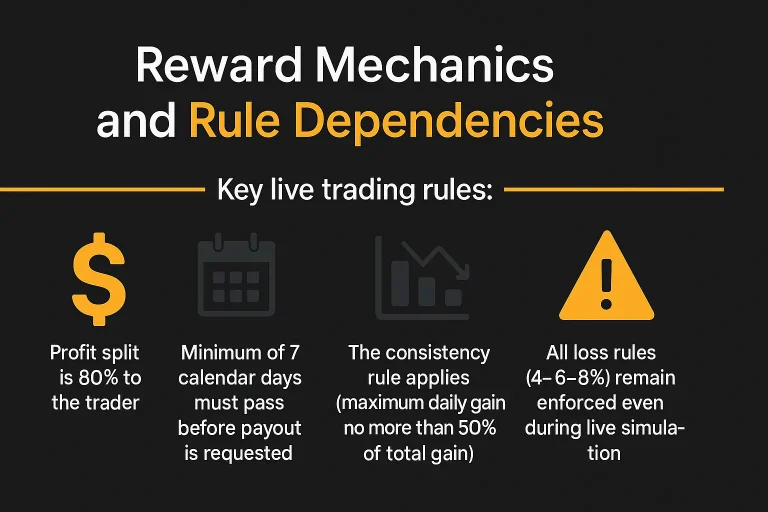

Reward Mechanics and Rule Dependencies

Once the evaluation phases are passed, the Live Simulated Trader phase begins. Rules still apply here, and payout eligibility is also bound by trader behavior.

Key live trading rules:

- Profit split is 80% to the trader.

- Minimum of 7 calendar days must pass before payout is requested.

- The consistency rule applies (maximum daily gain no more than 50% of total gain).

- All loss rules (4–6–8%) remain enforced even during live simulation.

These rules are not relaxed post-evaluation. The same discipline is required throughout.

Additional myfundedfx rules: Scaling and Account Merging

Some structural rules apply to trader progression beyond the initial funded simulation:

Scaling Plan Rules:

- Accounts scale by +25% every 90 days.

- Required 12% net profit during the 90-day period.

- The account must be at or above starting balance.

- Maximum cap is 5x original account or $1.5M.

Account Merging Rules:

- Merging is possible only between accounts of the same type and size.

- Requests are subject to approval.

- Merged accounts follow the same rules as individual ones.

Rule-Based Pitfalls to Avoid

- Ignoring the consistency rule in live phase and making most profits in one day.

- Hitting a drawdown limit due to oversized trades right before evaluation success.

- Trading during news events and expecting those trades to count toward results.

Conclusion

The myfundedfx rules are detailed, technical, and sometimes strict. They are not written to favor reckless trading or shortcut strategies. Instead, they are designed to evaluate a trader’s ability to preserve equity, meet targets under pressure, and maintain risk discipline. Success within the MyFundedFX framework depends more on planning and control than speed or volume. For traders who follow the structure and respect the evaluation framework, the system is predictable—even if demanding

FAQ:

No, unless specifically allowed. Most account types do not permit automated systems.

You fail the phase. Minimum trading days must be met, regardless of profit.

No. The 7-day minimum is fixed and non-negotiable.

No, but profits from trades executed within 3 minutes of high-impact news events do not count toward evaluation.

The account is failed, even if the profit target was already reached.