MyFundedFX Scaling Plan

Exclusive Code 10%: «PROP10»

Account Growth Through the scaling plan

The myfundedfx scaling plan exists to support traders who can consistently generate profits while managing risk. Instead of offering an instant large simulated account, MyFundedFX allows traders to build toward a maximum balance based on real performance within the simulation program.

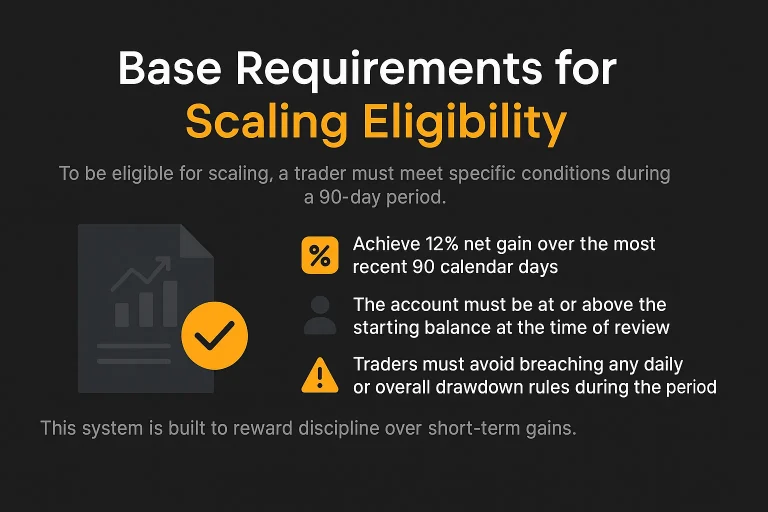

Base Requirements for Scaling Eligibility

To be eligible for scaling, a trader must meet specific conditions during a 90-day period. The scaling applies only to live simulated accounts and cannot be requested during challenge or verification phases. MyFundedFX outlines the rules clearly and doesn’t allow any exceptions.

Key scaling eligibility criteria:

- Achieve 12% net gain over the most recent 90 calendar days.

- The account must be at or above the starting balance at the time of review.

- Traders must avoid breaching any daily or overall drawdown rules during the period.

- Applies only to accounts that have passed all evaluation stages.

This system is built to reward discipline over short-term gains. The focus is on maintaining equity, not just reaching a percentage once.

Scaling Schedule and Structure

The scaling plan applies a consistent formula. Accounts are increased by 25% of the original size every 90 days if performance benchmarks are met.

Scaling Progression Table

Time Active | Account Balance (Starting at $100K) |

Start | $100,000 |

After 3 Months | $125,000 |

After 6 Months | $150,000 |

After 9 Months | $175,000 |

After 12 Months | $200,000 |

After 15 Months | $225,000 |

After 18 Months | $250,000 |

After 21 Months | $275,000 |

After 24 Months | $300,000 |

Maximum | $1,500,000 |

The table assumes the trader hits 12% every three months and keeps the account in good standing. Scaling stops when one of the following happens:

- Account hits $1.5 million

- Trader reaches 5x the original account size

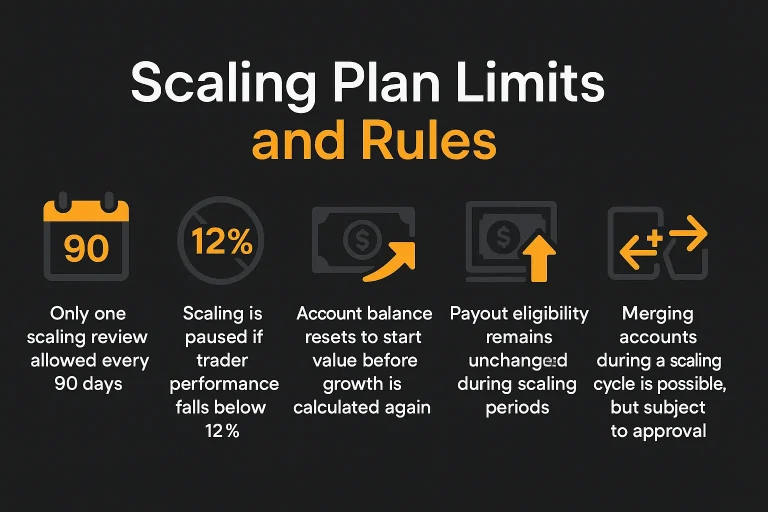

Scaling Plan Limits and Rules

While the plan offers clear growth potential, there are also limitations in place to reduce risk.

Main restrictions under the myfundedfx scaling plan:

- Only one scaling review allowed every 90 days.

- Scaling is paused if trader performance falls below 12%.

- Account balance resets to start value before growth is calculated again.

- Payout eligibility remains unchanged during scaling periods.

- Merging accounts during a scaling cycle is possible, but subject to approval.

These limitations are designed to prevent misuse and ensure that scaling rewards consistent, sustainable trading patterns.

How Scaling Affects Risk and Strategy

The scaling plan affects more than just the visible balance—it changes how traders should think about risk, volume, and capital exposure. Here’s how:

3 Practical Adjustments Traders Should Make:

- Lot sizing should match scaled balance, not emotional bias.

- Drawdown limits remain static, so larger trades can breach rules faster.

- Review periods mean capital growth isn’t guaranteed, even if profit targets are hit late in the cycle.

This makes the scaling plan most suitable for strategies that don’t rely on frequent large trades or margin-heavy setups.

Trader Considerations Before Joining

Before applying the scaling plan, consider the following checklist:

- Do you have a system that can sustain 4–6% monthly net return with low drawdowns?

- Are you tracking performance metrics daily, including losses and risk-to-reward?

- Can you keep your account above the starting balance under all conditions?

Only traders who meet these consistently are likely to benefit from scaling without interruptions.

Conclusion

The myfundedfx scaling plan is a performance-based model for growing your simulated trading balance within the MyFundedFX ecosystem. Instead of offering rapid expansion, it rewards traders who can deliver moderate but consistent gains without large drawdowns. The structure is clear, but strict. If you’re relying on volatility spikes or inconsistent profits, the plan likely won’t suit your strategy. On the other hand, those who trade methodically and preserve capital have a pathway to reach a high simulated account value over time.

It’s not a plan for everyone—but it is a plan for those who manage risk and think long-term.

FAQ:

You need to achieve a minimum of 12% net gain over the last 90 calendar days.

No. You are only eligible for one scaling request per 90-day period.

You will not be eligible for scaling in that period. You must be at or above the starting balance to qualify.

Yes, but only under conditions approved by MyFundedFX support.

No. The daily and overall drawdown limits remain unchanged regardless of balance increases.