MyFundedFX Withdrawal

Exclusive Code 10%: «PROP10»

When the MyFundedFX Withdrawal Process Starts

Withdrawals at MyFundedFX are only available to traders who complete the full evaluation structure and enter the Live Simulated Trader phase. There is no withdrawal option during the challenge or verification steps. Even after entering the live simulated stage, not all traders become immediately eligible.

To request a withdrawal, a trader must:

- Reach the Live Simulated Trader status after all phases.

- Trade for at least the required minimum calendar days.

- Avoid violating any risk rules, including daily and overall loss limits.

- Meet the consistency condition (if applicable).

- Generate simulated profit that meets the payout threshold.

Only after these are confirmed through the platform can the withdrawal be requested.

Withdrawal Structure and Conditions

The payout structure is directly linked to the trader’s performance. Profits are simulated and tracked automatically. The portion available to withdraw is defined by a fixed profit split policy.

Payout Terms and Internal Policy

Condition | Description |

Account Status | Must be “Live Simulated Trader” |

Profit Split | 80% to trader, 20% to firm |

Minimum Active Days | 7 calendar days (may vary by program) |

Profit Consistency Rule | 50% daily limit relative to total gain |

Simulated Drawdown Compliance | Must remain within all set drawdown rules |

Payout Request Timing | Requestable every 5 to 14 days depending on structure |

Traders must remain aware of the fact that myfundedfx withdrawal mechanics are closely connected to how well the account complies with the program’s daily and total risk parameters.

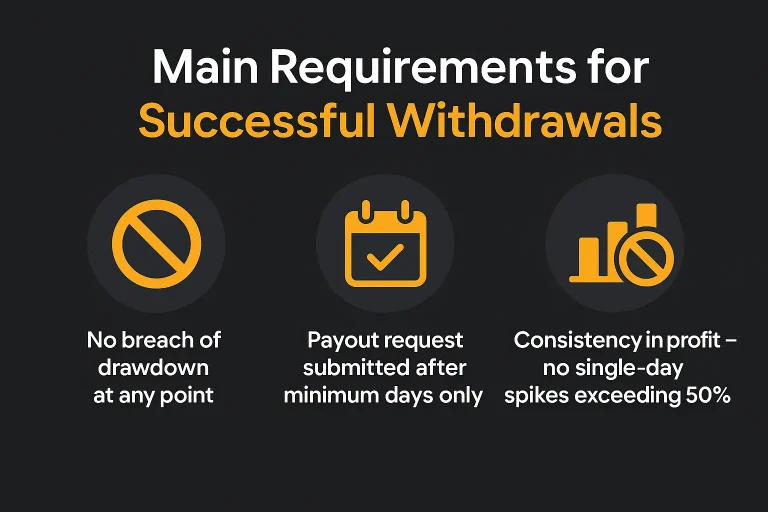

Main Requirements for Successful Withdrawals

There are specific rules that can result in disqualification from payout if not followed. The firm applies risk controls strictly.

Critical Requirements for Every Withdrawal

- No breach of drawdown at any point

- Payout request submitted after minimum days only

- Consistency in profit—no single-day spikes exceeding 50%

This applies whether the trader chooses the 1-Step, 2-Step, 2-Step Max, or 3-Step challenge. The structure and platform (DXtrader, MatchTrader) do not affect withdrawal access—but the rule enforcement is universal.

How to Submit a myfundedfx withdrawal Request

Once all requirements are satisfied, the trader will see a withdrawal eligibility notification in the dashboard. The process is then straightforward:

- Go to the “Live Simulated Account” section.

- Review current profit metrics.

- Click on “Request Payout” if available.

- Choose the payout method from listed options.

- Submit the request for internal review.

There is no fixed payment processor disclosed on the front end. Onboarding materials reference crypto and card use for payment, but withdrawals are subject to internal payout systems.

Common Payout Timeline

Once a request is submitted, processing may vary. Based on official timelines:

Payout Phase | Duration | Trigger Event |

Review of Account | 1–2 business days | Request submission |

Confirmation Email | 1 day | After account clears requirements |

Payout Sent | Within 5 days | If payment schedule is met |

Payment Method Used | Not disclosed | Case-dependent |

In some programs, the payout request becomes available only every 14 days, while others (e.g. 3-Step Live Sim) allow it after 5 calendar days.

Compliance Rules That Affect Withdrawals

Traders should carefully track compliance to avoid being locked out of payout:| Rule Type | Trigger for Violation | Result |

| Daily Sim Loss | >4% intraday equity loss | Payout denied, account failed |

| Overall Sim Loss | >6–10% depending on program | Payout blocked, evaluation reset |

| Consistency Rule | More than 50% profit on one day | Payout invalidated |

| Trading Period | Less than 7 calendar days traded | Delay in eligibility |

| News Trade Violations | Orders within restricted news windows | Profit from those trades excluded |

Conclusion

The myfundedfx withdrawal process is not automatic. It’s based on performance metrics and strict compliance with simulated trading rules. Traders who treat the funded account like a real account, manage risk, and meet all minimums will be able to receive payouts according to the outlined structure.

However, failing any of the technical requirements—even if by a small margin—can result in blocked payouts or account resets. The system is transparent, but unforgiving.

Those considering joining a MyFundedFX program should study the rules thoroughly and base their trading around the eligibility structure. The withdrawal process is systematic but depends entirely on the trader’s discipline.

FAQ:

No. Withdrawals are only available after reaching the Live Simulated Trader status.

There is no public cap, but payouts are limited to scheduled intervals (e.g. every 5 or 14 days).

The account is disqualified from withdrawal, even if profits were already generated.

No, but you must meet the minimum calendar days (usually 7) with profitable activity.

The firm does not list withdrawal fees, but method-specific fees may apply depending on the payment provider used.